First, the good news. U.S. manufacturing executives are optimistic about the impact of proposed tax, policy, spending and regulatory changes, which they believe will give an extra boost to their sales (+1.6%) and profits (+1.8%). This is according to the Supply Chain Readiness Study that TBM Consulting Group just completed in partnership with Aberdeen Group.

We’re still analyzing the data, and will be talking in depth about the research results in an upcoming report but I’m going to preview a few more highlights here.

When asked what could have the most impact on their businesses, manufacturers singled out 1) tax policies—corporate tax rates in particular—by a wide margin. No surprise there, of course. That’s followed by changes to 2) trade agreements, such as the North American Free Trade Agreement (NAFTA), 3) energy costs, 4) healthcare and 5) import duties.

US Policy Changes that Would Have the Biggest Impact on Manufacturers

- New tax policies (corporate tax rates)

- Existing trade agreement changes (like NAFTA)

- Energy costs

- Healthcare policy changes

- Import duties and tariffs: Supply sources

- New US bilateral trade agreements

- Free trade zones

- Brexit and EU agreement changes

- Import duties and tariffs: Preferred trade agreements

- Infrastructure spending

This brings us to the bad news, which should be a wake-up call for both policy makers and manufacturers. Four out of 10 research study participants report that they have already encountered sales resistance in export markets because of U.S. position or policy changes. And over half say that international trade barriers currently limit sales in growth markets. This is before any U.S. trade policy changes have been enacted, which could prompt retaliatory actions.

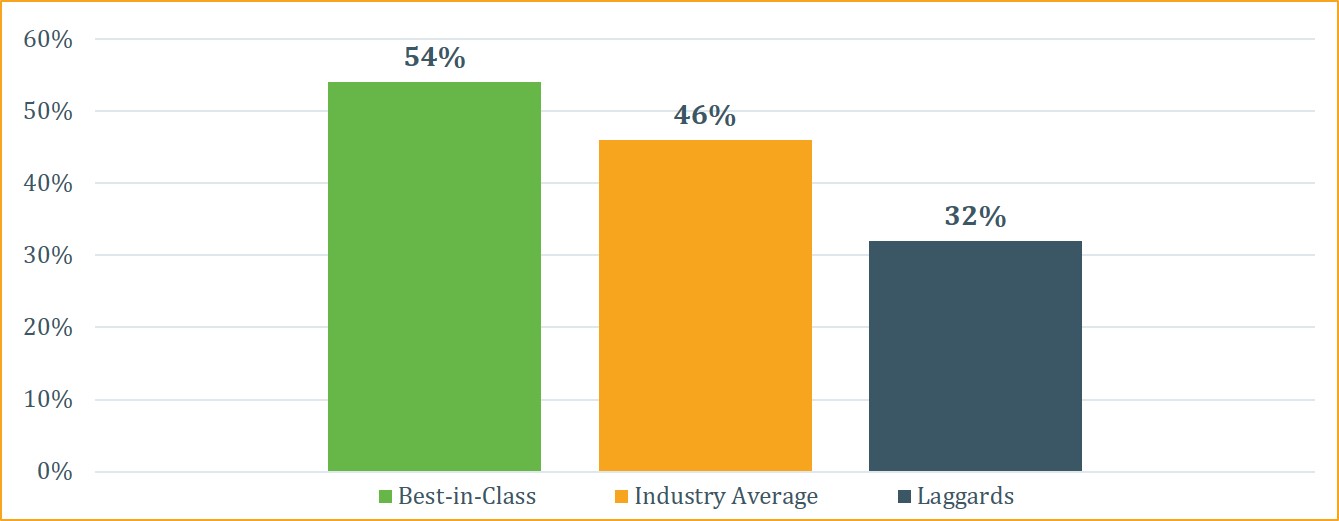

Some Organizations Are Beginning to Encounter Sales Resistance in Export Markets because of Recent U.S. Government Position or Policy Changes

We also asked manufacturing leaders about the most important supply chain management capabilities for successfully navigating potential policy changes, and how prepared their organizations are. The answer to the second question is that they’re not well prepared, which I’ll explore more in my next post about the research. Whatever regulatory and policy changes are ultimately enacted by the Trump Administration and Republican Congress, let’s hope that the positive impact on manufacturing businesses vastly overshadows any negative consequences.